Looking for the most powerful Stripe and Salesforce integration on the market?

Blackthorn Payments delivers a secure Salesforce-native solution to process payments without ever leaving your CRM.

As an official partner of both Salesforce and Stripe, Blackthorn is trusted by organizations that need to process payments, manage subscriptions, and keep every financial record connected to Salesforce data.

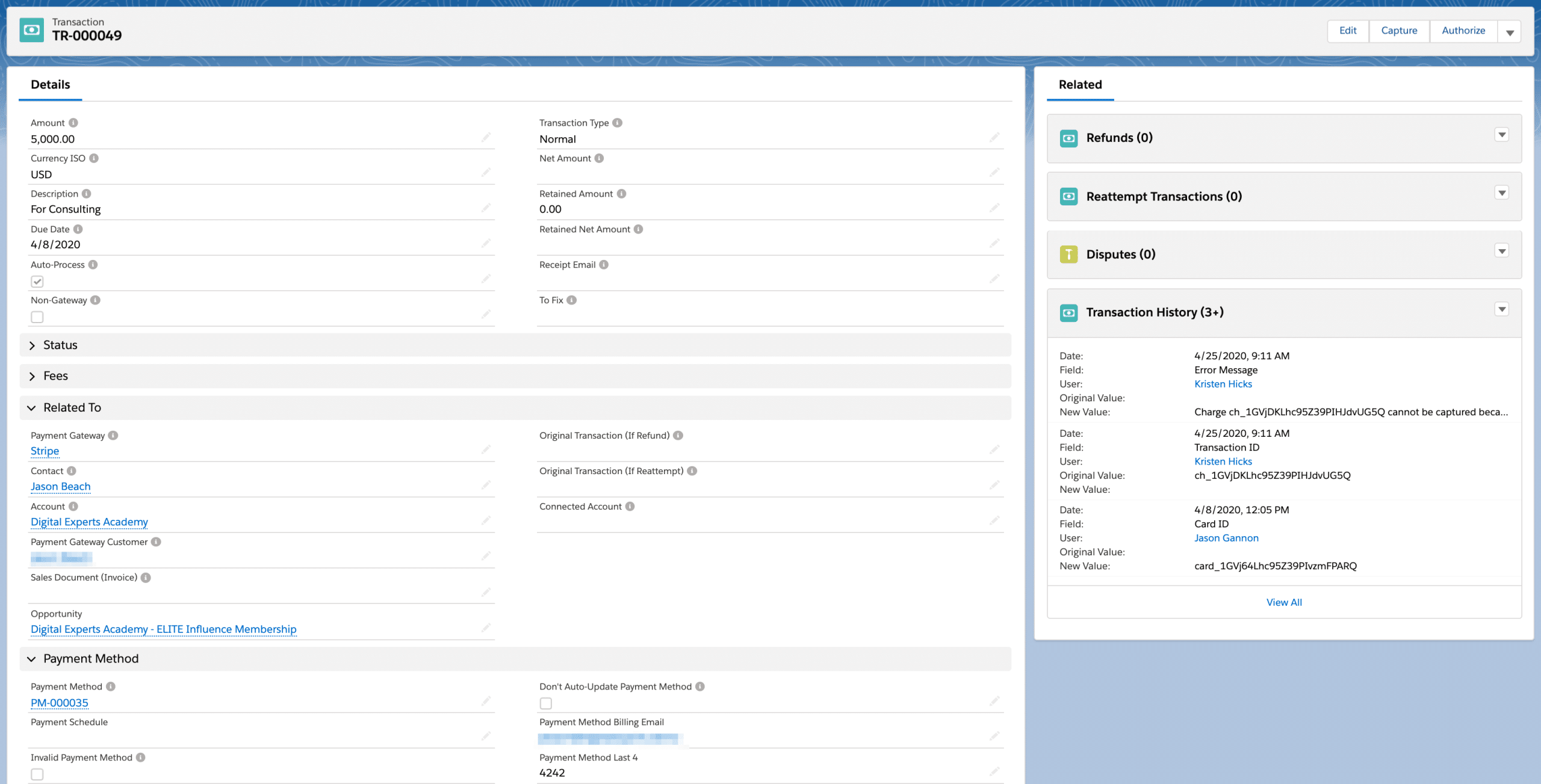

With Blackthorn Payments, Salesforce users can manage everything Stripe offers without leaving Salesforce. Because our application is 100% native (meaning our app is built inside of Salesforce and uses records and automation logic), Blackthorn lets you process credit/debit cards and ACH payments directly from your Salesforce org. Connect PCI-compliant transaction data to your customers’ record through a unique transaction record.

Why Blackthorn for Stripe and Salesforce Integration?

Blackthorn Payments transforms Salesforce into your central payment hub, allowing teams to process credit cards, ACH transactions, and recurring payments directly in Salesforce.

With our 100% native app, you get:

- Complete data accuracy: Transactions automatically sync with Salesforce records.

- Faster cash flow: Collect payments immediately instead of waiting for invoices.

- Fewer manual errors: Eliminate double entry and reconciliation headaches.

- Better visibility: Access real-time payment data and reports from Salesforce.

This Stripe and Salesforce integration empowers organizations to scale faster, automate billing, and deliver a smoother customer experience.

Payment Processing Features

Our integration supports every type of payment workflow, from quick one-time charges to complex recurring billing.

PayLink

Send personalized payment requests via email with a single click.

Ideal for recurring payments, event registrations, or vendor onboarding. Watch a quick demo.

DocumentLink

Send secure digital invoices powered by Stripe so customers can pay directly from their browser.

Track every invoice and payment right inside Salesforce. Watch a quick demo.

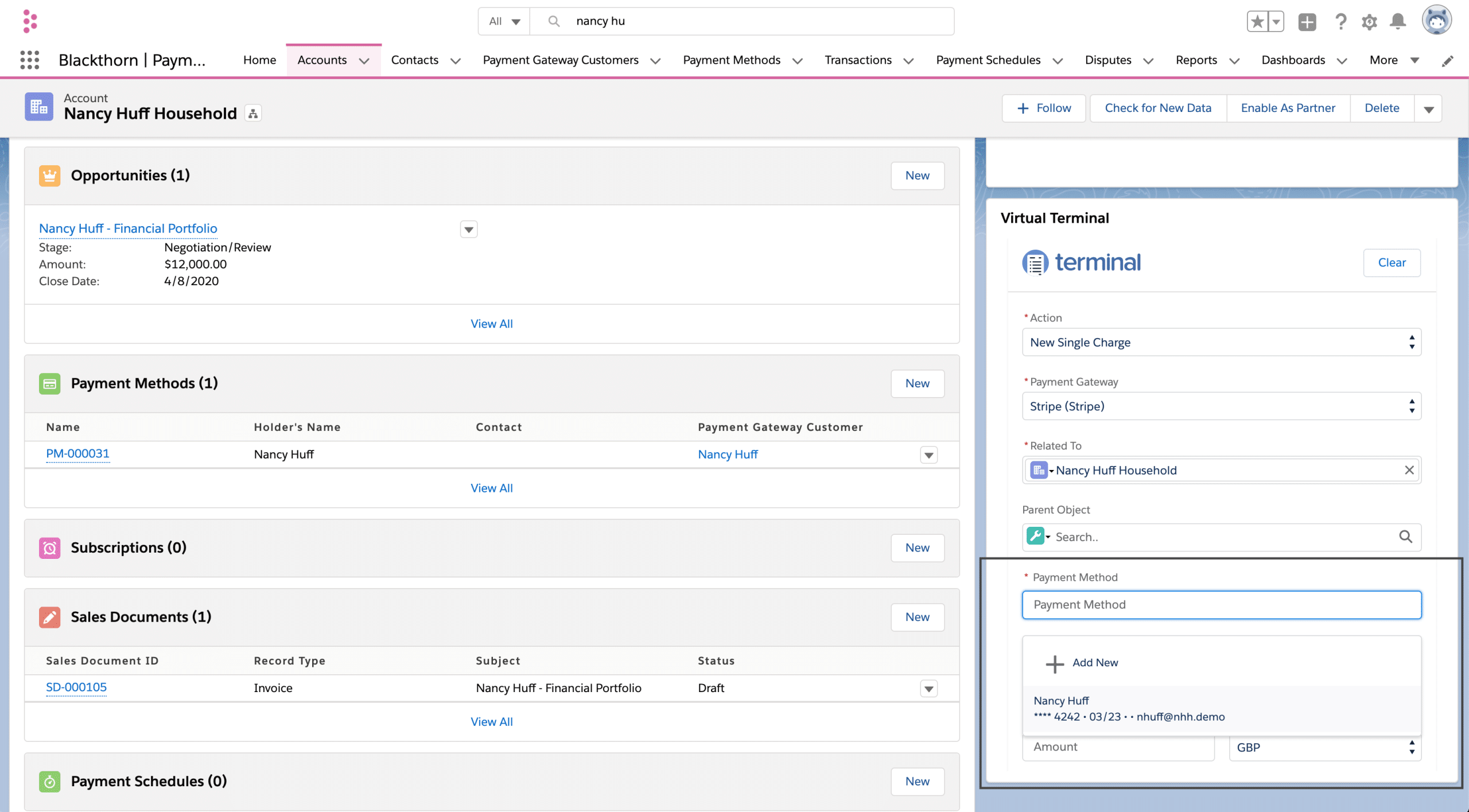

Virtual Terminal

Process card-not-present transactions in person, over the phone, or through your Salesforce Community portal.

Schedule future payments, store cards securely, or process one-time transactions instantly. Watch a quick demo.

Bonus: Take on-site payments using Blackthorn Mobile Payments with Salesforce Mobile or Field Service Lightning.

Common Use Cases for Stripe and Salesforce Integration

Here’s how teams use Blackthorn Payments to simplify payment operations:

- Pay by Email: Send PayLinks to collect onboarding or recurring payments.

- Update Expired Cards Automatically: Use reattempt logic to email PayLinks for new card information.

- Accept In-Person Payments: Use Stripe card readers connected to Salesforce Mobile.

- Manage Subscriptions: Configure recurring billing or connect with Stripe Billing for advanced use cases.

This integration supports everything from one-time donations to enterprise-level subscription management.

Technical Advantages of Blackthorn Payments

Our Stripe and Salesforce integration is built for flexibility, security, and scalability.

- All workflows are Level 3 PCI-Compliant.

- Sensitive card data is sent directly to Stripe, never stored in Salesforce.

- Stripe generates a secure token for future charges, synced automatically to Salesforce.

- Real-time data flow through webhooks ensures both platforms remain perfectly aligned.

This architecture delivers a powerful balance of speed, safety, and simplicity so you can focus on growing revenue instead of managing payment logistics.

The Real Benefit: Unified Data in Salesforce

When every payment, subscription, and refund lives inside Salesforce, you gain a complete view of your financial health.

With the Stripe and Salesforce integration, you can:

- Build real-time revenue and cash flow dashboards.

- Track ARR/MRR and subscription performance.

- Forecast more accurately using Salesforce reports.

- Make faster, data-driven business decisions.

Blackthorn Payments turns Salesforce into the single source of truth for your payment ecosystem.

Frequently Asked Questions

How secure is the Stripe and Salesforce integration?

Blackthorn Payments uses Level 3 PCI Compliance and routes all sensitive data directly through Stripe. Salesforce only stores tokenized and non-sensitive information for reporting and automation.

Can I issue refunds directly from Salesforce?

Yes. Refunds can be processed right from the transaction record in Salesforce. All refund data syncs automatically back to Stripe.

Does this integration support recurring billing?

Absolutely. You can manage simple recurring payments within Blackthorn Payments or integrate with Stripe Billing for advanced subscription logic.

Ready to Improve Your Payment Processing?

With Blackthorn’s Stripe and Salesforce integration, you can process payments faster, reduce manual work, and get real-time visibility across your entire organization.

Talk to an Expert to see how Blackthorn can simplify your payment operations today.

Ready to simplify how you accept and manage payments in Salesforce?

Discover how Blackthorn Payments streamlines payment collection, reduces friction, and gives your team full visibility.