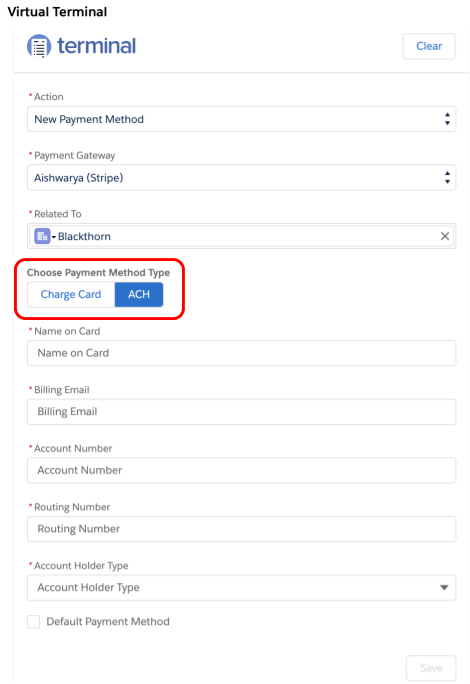

Give your customers the flexibility to make payments with both credit cards and ACH while taking PCI-compliant payments directly from your Salesforce application using Blackthorn Payment’s updated Virtual Terminal. The addition of ACH to the Blackthorn Terminal means that your customers have several payment options available.

The configurable Virtual Terminal lets teams process card-not-present transactions in-person, or through a Communities billing portal. You can also add cards or ACH and schedule recurring payments to charge automatically on a future date.

What makes Blackthorn different from other native payment processing apps is our heightened level of PCI-compliance. Transaction data, like amounts, dates, and last four of the card, is connected to your customers’ records through a unique transaction record, but the actual card and bank payment data are never stored within Salesforce.

Take payments within Salesforce using Stripe and Authorize.net ACH setup is simple.

- Stripe Users: simply utilize micro-deposits and create an ACH payment method with a pending state. Once the micro-deposit is validated, you can utilize ACH in the virtual terminal.

- Athorize.net Users: Validation of ACH payments is instantaneous. After validating, you simply take payments, and transaction records associated with your Salesforce records are created automatically.

The flexibility and data security of the Blackthorn Virtual Terminal are two reasons why our customers choose Blackthorn Payments.

See for yourself by getting started with a free trial today or talk to a sales expert for more information.