Blackthorn Payments provides the deepest Salesforce and Stripe integration available on the Salesforce AppExchange. Because we’re a trusted, official partner to both Salesforce and Stripe, teams can feel safe knowing they’re using a solution that’s on the forefront of online payment processing and customer relationship innovation. With Blackthorn Payments, Salesforce users can manage everything Stripe offers without leaving Salesforce. Because our application is 100% native (meaning our app is built inside of Salesforce and uses records and automation logic), Blackthorn lets you process credit/debit cards and ACH payments directly from your org. Connect PCI-compliant transaction data to your customers’ record through a unique transaction record.

From a one-time payment, to complex recurring payments and payout flows, organizations can accept and process payments using our three payment tools.

- PayLink: Send requests for customers to pay via email using Blackthorn’s PayLink feature. Watch a quick demo.

- DocumentLink: Send requests for customers to pay through a digital invoice using Blackthorn’s DocumentLink feature. Watch a quick demo.

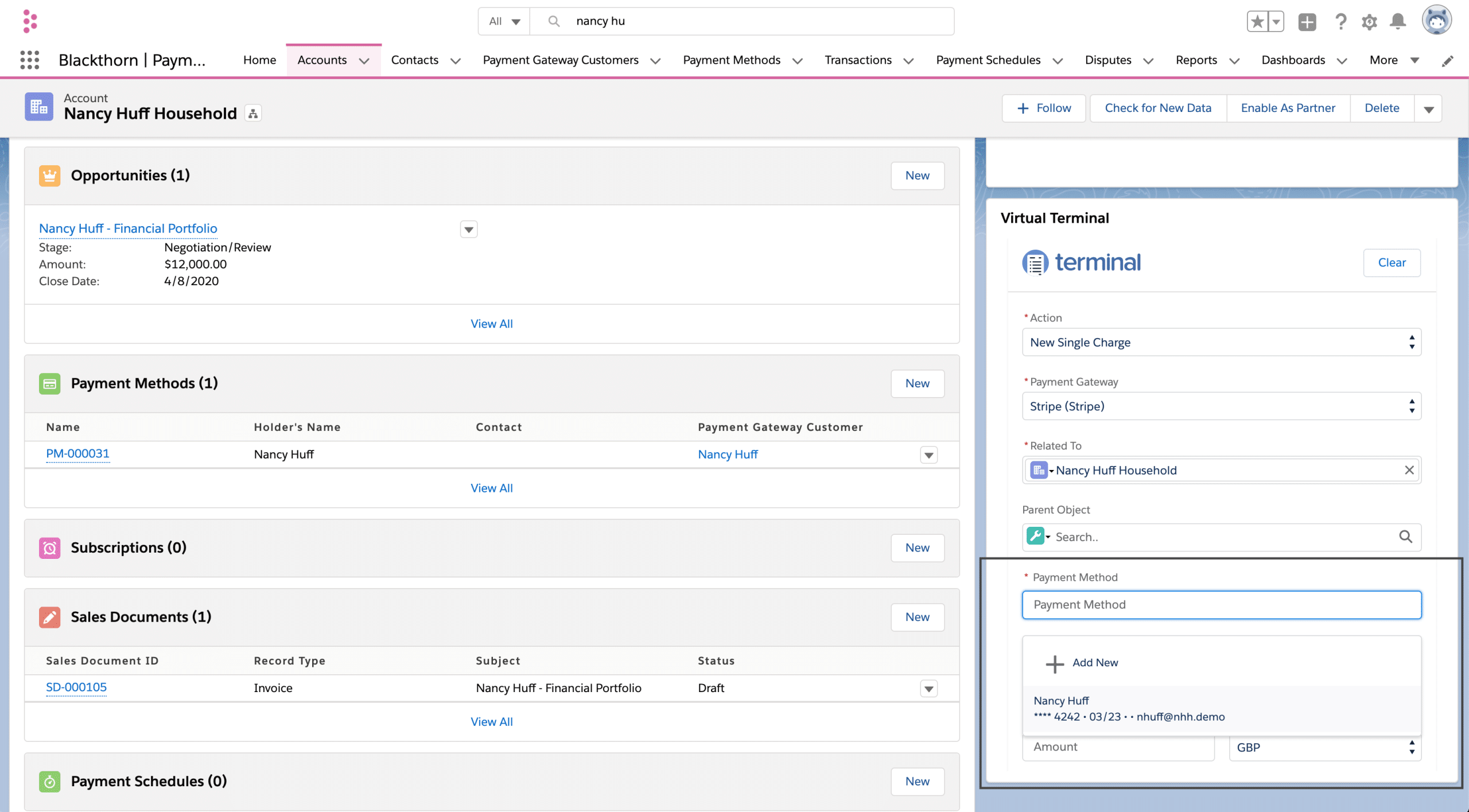

- Virtual Terminal: Agents or employees can create or schedule automatic future transactions for a customer manually using Blackthorn’s Virtual Terminal. The configurable Virtual Terminal processes card-not-present transactions in-person, over the phone, or through a Communities billing portal. You can also add cards and schedule payments to charge automatically on a future date. Watch a quick demo.

To give you a better idea, here are a few common use cases for PayLink and DocumentLink.

- Pay by Email. Send a vendor or customer onboarding request via email to set up a card to charge on a recurring or subscription basis (Paylink, DocumentLink, or others like DocuSign).

- Automatically Update Expired Cards. When a customer’s card expires, use our reattempt logic to fire an automatic email with a PayLink to enter updated card information.

- Take Payments On-Site With a Card Reader. Use Blackthorn’s Mobile Payments app to take in-person payments using Salesforce Mobile or Field Service Lightning. Find out more.

- Set up Recurring Billing or Subscriptions. Use Blackthorn Payments for basic subscriptions or use our Stripe Billing integration for more complex subscription needs. Manage and view historical revenue, subscriptions, ARR/MRR, subscription statuses, and plans.

Let’s get technical.

Blackthorn’s solution is extremely flexible, letting you customize payment workflows to fit your business’s unique payment processes. And because we understand the importance of secure data, all payment processes are Level 3 PCI-Compliant.

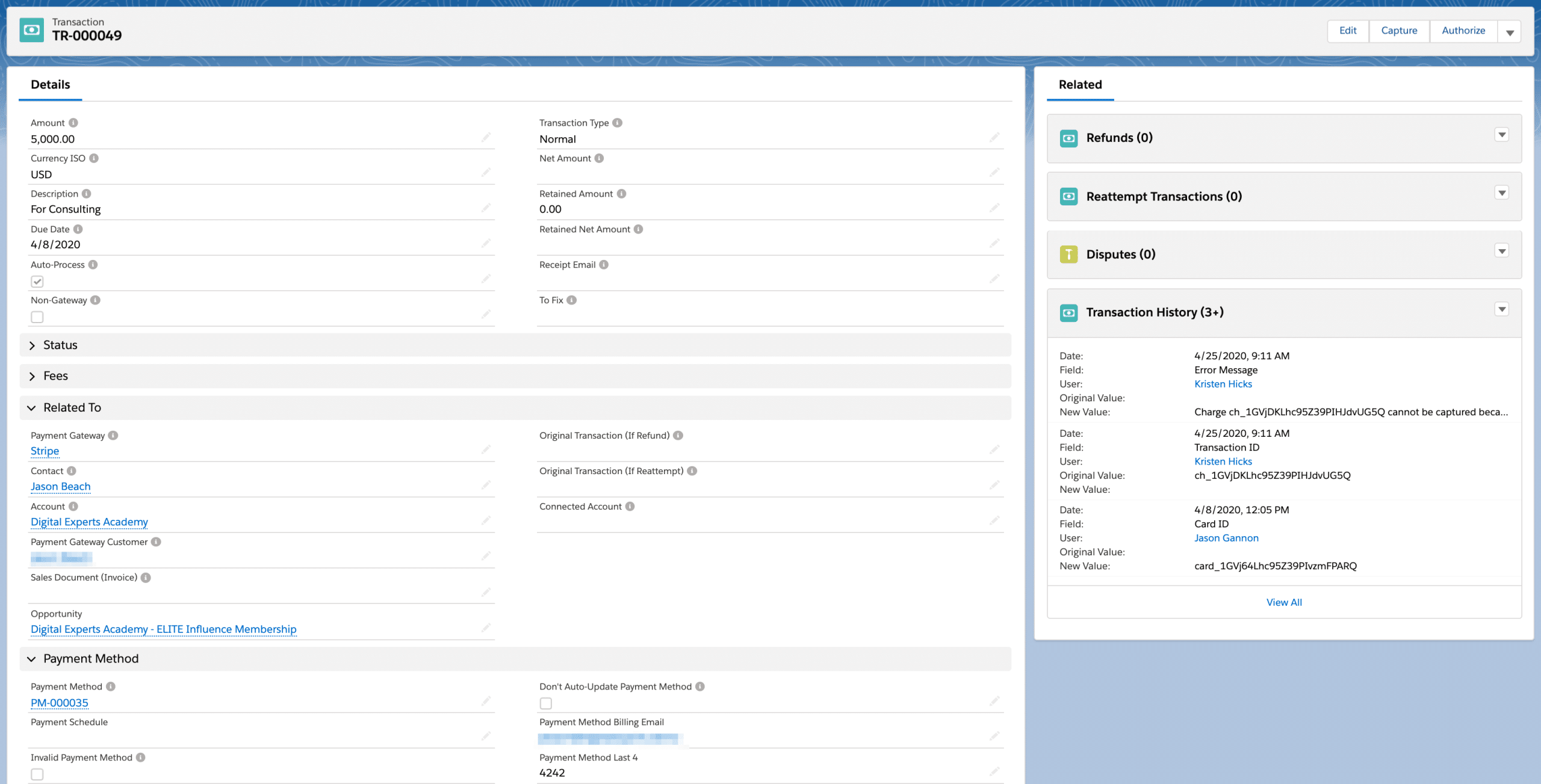

When card information is entered (either by the customer or a team member), sensitive card information is routed directly to Stripe, while basic information like dates and amounts get stored in Salesforce on related transaction records. Once it hits Stripe, through API’s, Stripe creates a stored token (a PCI-compliant record of the card) that routes back to Salesforce so users can view the card charged or use for later recurring charges. Data across both platforms is synced through webhooks, which means you can start payment processes in Stripe or Salesforce and the data can flow into one or both platforms.

So what’s the real benefit? All of your data in Salesforce.

- Streamline time-consuming, repetitive payment processes and scale, FAST. The Stripe and Salesforce integration allows for native payment processing and resolves reconciliation challenges. By enabling immediate payment collection instead of waiting for a 30-day invoice, teams can achieve faster time-to-payment and eliminate the need for future reconciliations. Furthermore, this integration ensures secure transaction data is linked to any specified Salesforce object, removing the risk of human errors as data is entered only once.

- Get a holistic view of your business financials using Salesforce reporting. When payment dates and amounts are viewable in Salesforce, you can create financial reports that show real-time information about your business’s financials. Make customer-centric, revenue-driving decisions faster.

If any of the scenarios above could help streamline your payment processes, scale your business fast by setting-and-forgetting payment processes? Reach out today.